2023 IRS Form 2290

- 18 September 2023

The world of US taxation is a colossal puzzle that often overwhelms ordinary citizens. As we swing into 2023, various tax returns may appear on your radar. A standout among such documents you might need to handle is Form 2290 for 2023 in PDF. Let's help you dive into its depths and elucidate how to work with it.

Terms to File Form 2290 in 2023

Contrary to popular belief, not everyone needs to file the 2023 2290 tax form (also known as HVUT). The mandate leans on a certain set of conditions you must fulfill. For instance, tax year 2023 might involve filing IRS Form 2290 if you own and operate a highway motor vehicle that weighs 55,000 pounds or more. But it isn't limited to this scenario alone. All unique circumstances are elaborated in the 2023 Form 2290 instructions available.

- Heavy Highway Vehicles

If you are using a vehicle on any US public highway with a taxable gross weight of 55,000 pounds or more, you would need to file Form 2290. - Fleet Owners

Anyone owning more than 25 vehicles used on the highways, each weighing more than 55,000 pounds, must also file Form 2290. - Special Purpose Vehicles

Various categories of off-highway and special-purpose vehicles are exempt from Form 2290, but certain specifications can make them eligible. Check the IRS guidelines for detailed information.

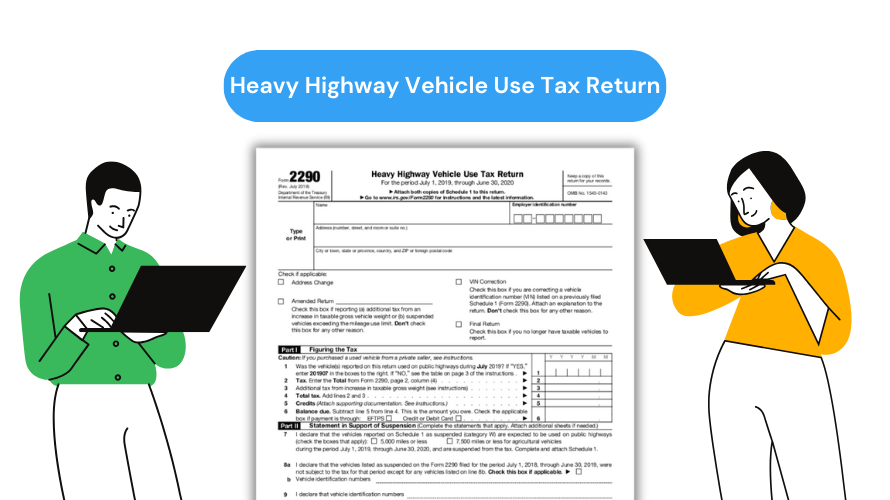

Fixing Form 2290: How to Correct Mistakes

Everyone makes mistakes, and it's the same when it comes to filing tax returns. It's critical to correct such errors promptly to avoid potential complications. The 2023 IRS Form 2290 has a special column to rectify errors, as clearly outlined in the instructions and guidelines.

The 2290 HVUT Form Due Dates

Knowing when to file IRS Form 2290 for 2023 is equally crucial. The IRS mandates the 2290 copy to be filed and tax paid by the last day of the month following the month of the vehicle's first use. For instance, if you first used your vehicle in July 2023, your IRS Form 2290 must be filed by August 31, 2023.

Frequently Asked about the 2290 Tax Form

- Can I file Form 2290 for 2023 online?

Yes, the IRS encourages online filing for faster processing. You can find the template online on our website and download it in PDF format. Remember to follow the 2023 Form 2290 instructions closely while filling it out. - What if my vehicle is stolen after I've paid the tax?

If your vehicle is stolen after payment of the tax, you can claim a credit for the tax paid on the next Form 2290 you file. - What happens if I don’t file the Form 2290?

If you fail to file your 2023 IRS Form 2290 by the due date, you may have to pay a penalty in addition to the tax due.