2290 Online Form

- 15 September 2023

Understanding tax forms can be a challenging task, and one of the forms that often confounds taxpayers is the IRS Form 2290. Known as the 'Heavy Highway Vehicle Use Tax Return,' this form is utilized by truck owners or operators with heavy motor vehicles weighing 55,000 pounds or more that use public highways. The good news is you can now file IRS Form 2290 online, simplifying the process significantly and making tax payment more convenient. Hassles, queues, and outdated tax procedures can now be avoided, as completing Form 2290 for online filing is a click away.

The Interactive IRS 2290 Online Form

Technology has immensely made procedures more efficient and accessible for users, and the IRS is not left behind. The IRS offers an interactive, fillable version of the 2290 online form - a tool designed to assist you in preparing and filing your returns electronically.

- It's a handy feature that saves time and avoids the usual paperwork.

- With the online 2290 form, you can now fill out the required fields, calculate your tax dues, submit payments, and receive a stamped Schedule 1 in minutes.

- Moreover, the IRS sends an e-mail confirmation once the form has been filed correctly, adding an extra layer of verification to ensure accuracy.

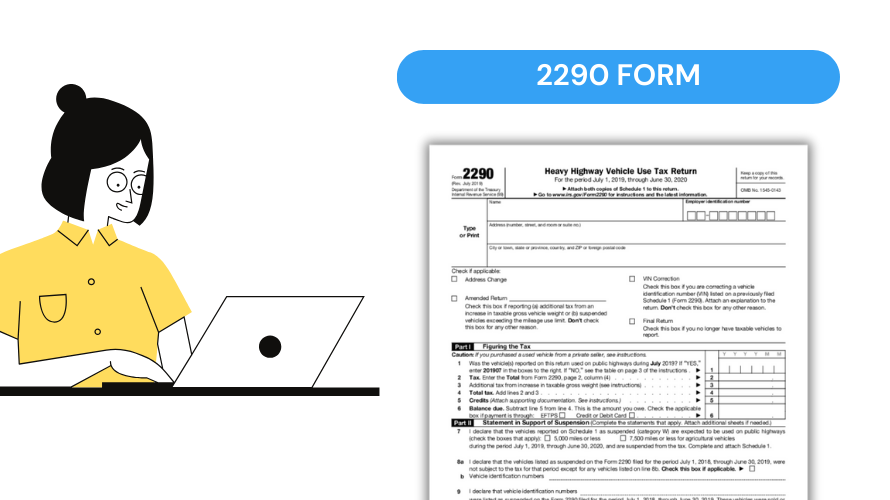

IRS Form 2290 & Possible Difficulties

Though the process has been designed to be user-friendly, you may still encounter potential challenges while using Form 2290 for online filing. While filing, errors may occur in Vehicle Identification Numbers (VINs), weight categories, or tax computation. Likewise, electronic malfunction or internet instability could pose minor technical hitches. Knowing these challenges beforehand will help users better prepare and mitigate them as much as possible. Ensure all necessary details like EIN, VIN, and Gross weight details are also handy to prevent any inaccuracies.

Tips to File Your 2290 Form Online

While most of us dread tax time, understanding how to complete your IRS 2290 form online correctly can alleviate some stress.

- After successful e-filing and payment, checking your e-mail for the IRS confirmation is crucial. This verifies that your form was successfully filed.

- In case of any discrepancies or inaccuracies, the form can be amended online.

- Lastly, remember to prioritize safety against fraud and only use trusted and secure platforms to file IRS Form 2290 online.

Understanding the intricacies of this tax form and using accurate information is critical to successfully completing your 2290 form online.

As we embrace digital solutions in most day-to-day procedures, remember that tax filing can be simple. The aim of this guide is to make your tax filing process easier and more efficient.