IRS 2290 Tax Form in PDF

- 14 September 2023

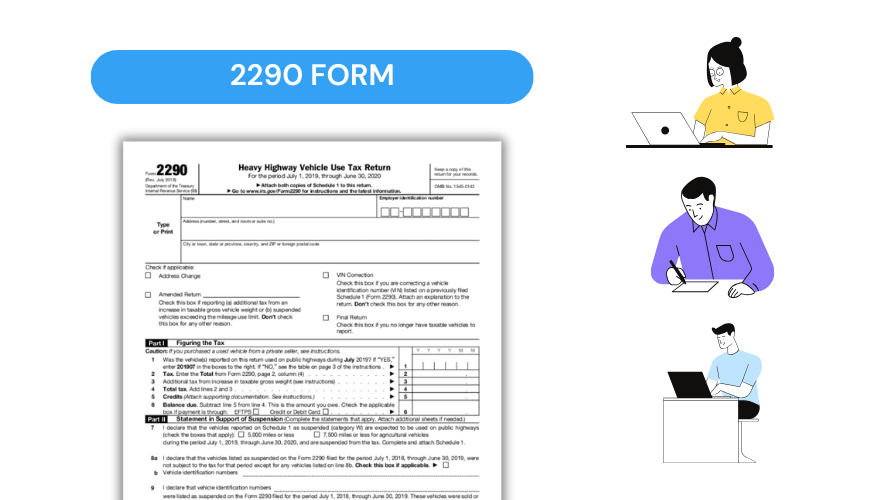

Before diving into the heart of our discussion, let's paint a basic picture of the IRS 2290 tax form in PDF format. This form, also known as the Heavy Vehicle Use Tax (HVUT), is used by truck owners or operators reporting a heavy highway motor vehicle. This includes trucks, truck tractors, and buses with a taxable gross weight of 55,000 pounds or more. Simply put, if you own a heavy vehicle and use it on public highways, the IRS requires you to pay a federal highway use tax via this form.

Who is Exempted from IRS Form 2290?

Several vehicle owners need to fill out this form, but a few exemptions exist. Only some heavy vehicle owners are mandated to report. Here are some examples of people who may be exempt:

- Governmental Organizations

Federal, state, and local government organizations, including the District of Columbia. - American Red Cross

The ‘ARC’ vehicles are excluded from the HVUT tax. - Non-Profit and Educational Organizations

These include any non-profit volunteer ambulance association, fire department, rescue squad, etc. - Indian Tribal Governments

As long as the vehicle is used for essential tribal government functions.

Filing the 2290 Form for 2023 on Time

Let’s illustrate its function with an example. Assume you are the owner-operator of a fleet of trucks. In the tax period of July 2023 to June 2024, you added a 60,000-pound truck to your fleet in November 2023. You will need to submit your 2290 form for 2023 in PDF by the end of the next month, i.e., December 2023. Once your 2023 Form 2290 PDF is processed, you will receive a stamped Schedule 1 form as proof of payment. This receipt is critical as it is often required by state DMVs to register your vehicle.

Common Problems with Form 2290 PDF

Dealing with tax paperwork can be daunting, especially regarding Form 2290 in a fillable PDF. That's why it’s essential to address common challenges taxpayers might face when filing this form and offer solutions to ease the process. Here’s a handy quick-reference table:

| Common Problems | Solutions |

|---|---|

| Uncertainty about taxable vehicles | Refer to IRS guidelines or consult a tax professional. |

| Errors while filling out the form | Review the form thoroughly before submitting it. |

| Misplacement of approved Schedule 1 | Request duplicate from IRS. |

Simply put, IRS Form 2290 in PDF format is crucial for owners and operators of heavy highway vehicles. By understanding its purpose, recognizing common challenges, and learning to navigate these, the filing process can be much smoother and stress-free.