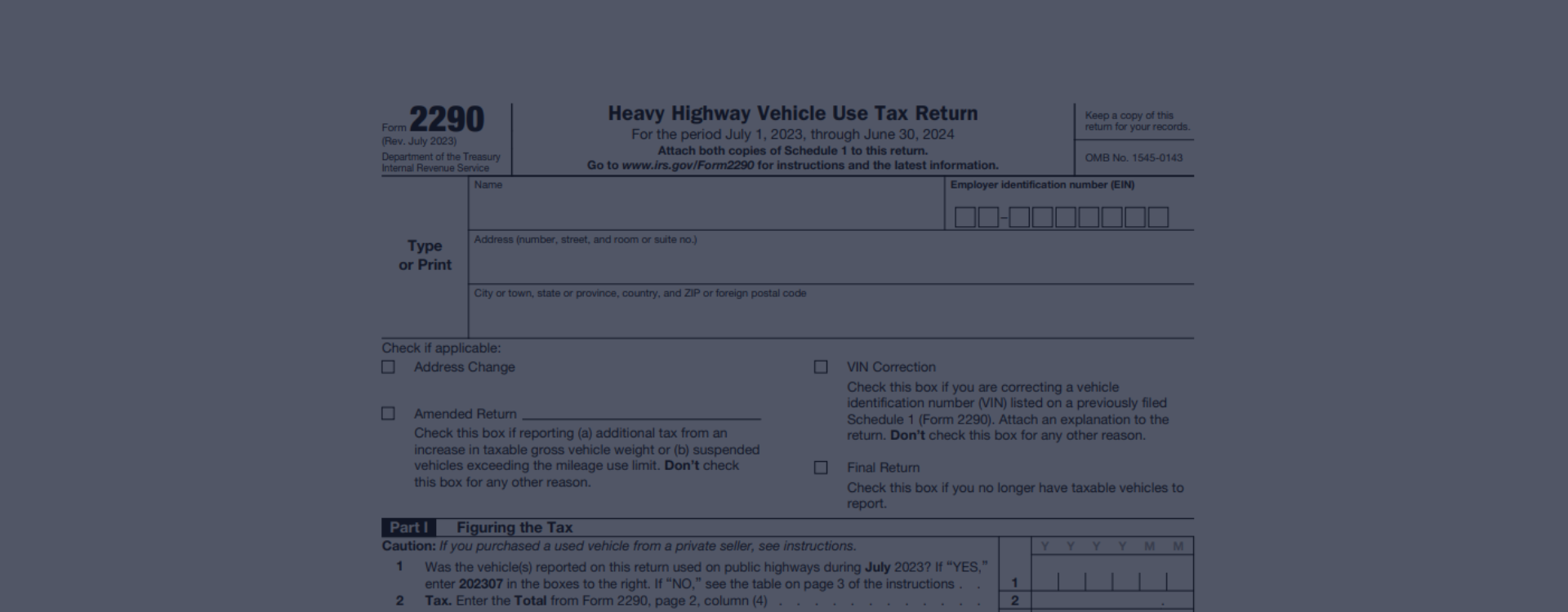

IRS 2290 Form: Outlining HVUT Essentials for 2023

Widely known as the Heavy Vehicle Use Tax (HVUT 2290 form) is a crucial document designed by the Internal Revenue Service (IRS). This is mainly meant for those who own or operate heavy vehicles with a gross weight of 55,000 pounds or more that are extensively used within the United States. Much like your school report card, this form is a record-keeping document - it presents clear evidence that you've fulfilled your tax obligations towards your heavyweight vehicles for a certain period.

Our Website Advantages

Venturing into the realm of IRS Form 2290, our website, 2290-printable-form.com, stands as a valuable assistant. It is a user-friendly platform, a portal where you can find a 2290 form to print out with a wealth of related materials, including but not limited to easy-to-follow instructions and numerous practical examples. It can make the sometimes-daunting task of filling out this form much less perplexing. Much like a tutor providing you with worksheets for practice, our website offers the IRS 2290 form for download along with resources to polish and apply your knowledge effectively.

The 2290 Tax Form Functionality

-

![Simplified Reporting]() Simplified ReportingThe 2290 form offers an uncomplicated method of reporting your heavy vehicle use tax. Imagine it like a class register where you sign your name; instead of a physical register, you provide necessary information about your heavy vehicle on the copy.

Simplified ReportingThe 2290 form offers an uncomplicated method of reporting your heavy vehicle use tax. Imagine it like a class register where you sign your name; instead of a physical register, you provide necessary information about your heavy vehicle on the copy. -

![Rapid Receipts]() Rapid ReceiptsOnce you file the printable IRS Form 2290, you receive a stamped Schedule 1 almost immediately. It's as if you've ordered a meal and received it without delay, ensuring you have the required proof of payment swiftly.

Rapid ReceiptsOnce you file the printable IRS Form 2290, you receive a stamped Schedule 1 almost immediately. It's as if you've ordered a meal and received it without delay, ensuring you have the required proof of payment swiftly. -

![Priority Processing]() Priority ProcessingWhen you use the electronic filing option for the 2290 form, your documents are prioritized. It's akin to using a fast lane in traffic, ensuring a quicker completion and submission of your tax requirements.

Priority ProcessingWhen you use the electronic filing option for the 2290 form, your documents are prioritized. It's akin to using a fast lane in traffic, ensuring a quicker completion and submission of your tax requirements.

IRS 2290 Tax Form in PDF

Get FormIRS Form 2290 Rules for Heavy Highway Vehicle Drivers

In the United States, the Internal Revenue Service (IRS) requires certain individuals and business entities to file Form 2290, colloquially known as the Heavy Highway Vehicle Use Tax Return. Primarily, a free printable 2290 form for 2023 is necessary for owners of trucks and other heavy highway vehicles with a taxable gross weight of over 55,000 pounds.

In the United States, the Internal Revenue Service (IRS) requires certain individuals and business entities to file Form 2290, colloquially known as the Heavy Highway Vehicle Use Tax Return. Primarily, a free printable 2290 form for 2023 is necessary for owners of trucks and other heavy highway vehicles with a taxable gross weight of over 55,000 pounds.

Our first example of such a person is Mr. John, a small business owner. John operates a fleet of cargo trucks weighing significantly above the limit. His company, 'John's Logistics,' is based in Kansas and routinely sends these heavy vehicles on interstate cargo missions. As such, John is required to file Form 2290 online for free to fulfill the IRS criteria.

On the other hand, we have Miss Susan, another typical taxpayer necessitated to file this tax form. Susan is an independent trucker from Texas. She owns a mighty 18-wheeler, which she operates solo, using it for heavyweight cargo deliveries throughout the country. To meet her legal obligations, Susan, too, must print a 2290 tax form and file it with the IRS.

Printable Form 2290: Fillable Boxes & Requested Data

Filing Form 2290 correctly is critical to ensure your taxes are in order. Our website conveniently provides a free 2023 Form 2290 in PDF for your perusal and ease of use. This makes it simpler to fill out online or by printing it off.

- To avoid mistakes, carefully review the IRS Form 2290 instructions for the current year. These instructions provide a comprehensive guide on the specific information required in each form box. You should complete each box accurately with the relevant details.

- The next step is to fill out printable Form 2290 for 2023 with your personal and business particulars like name, address, business name, and Employer Identification Number (EIN). Double-check for typographical errors, which could lead to confusion and processing delays.

- Finally, provide the details of all the trucks under your name, keeping a close eye on the Vehicle Identification Number (VIN) and gross weight.

Following these simple steps, you can easily file the 2023 IRS Form 2290 printable without unnecessary mistakes.

The 2290 Tax Return Due Date

The matter of taxation is an essential part of United States governance. Each citizen, as a responsible person, must provide timely and accurate data. A key place for these responsibilities is the 2290 truck tax. This important document must be submitted to the Internal Revenue Service (IRS) by August 31st each year.

Get FormForm 2290 & IRS Penaltization System

Considering the seriousness of taxation, neglecting to file this document on time could have significant ramifications. Let's imagine a high school student handing in a late assignment - there would be consequences, right? Similarly, penalties may be imposed if printable tax form 2290 is submitted late. These penalties also apply to the provision of incorrect or false data. In essence, providing fraudulent details is akin to lying about the sources for your school essay. The IRS takes these matters seriously.

2290 Highway Use Tax Form: Popular Questions

- What exactly is the Heavy Vehicle Use Tax Form 2290?It's an Internal Revenue Service (IRS) document used by anyone responsible for filing a return for a highway motor vehicle with a taxable 55,000 pounds (or more) gross weight. The revenue collected from these copies is used to fund highway infrastructure maintenance.

- Where can I find the 2290 printable form for 2023?Our website allows users to access the printable version for the year 2023, thus making it easier to fulfill their tax obligations. It can be completed and mailed directly to the IRS.

- Can the IRS Form 2290 printable for 2023 be filed online?Indeed, besides providing a printable version, our website also offers an option to fill out the tax return digitally. This gives users a more straightforward, faster, and more efficient method to meet their tax responsibilities.

- When is the filing deadline for the IRS 2290 form for 2023 printable?The official deadline is the last day of the month following the month of the vehicle's first use. For instance, if you first used your vehicle in June 2023, you should file your IRS Form 2290 by July 31, 2023.

- What happens if I file the IRS 2290 form printable copy late?If you fail to file your 2290 copy by the deadline, the IRS may fine you with penalties or interest. The typical penalty for late filing is 4.5% of the total tax due, and this charge increases monthly for up to five months.

IRS Tax Form 2290 Instructions for 2023

2023 IRS Form 2290 The world of US taxation is a colossal puzzle that often overwhelms ordinary citizens. As we swing into 2023, various tax returns may appear on your radar. A standout among such documents you might need to handle is Form 2290 for 2023 in PDF. Let's help you dive into its depths and elucidate how to...

2023 IRS Form 2290 The world of US taxation is a colossal puzzle that often overwhelms ordinary citizens. As we swing into 2023, various tax returns may appear on your radar. A standout among such documents you might need to handle is Form 2290 for 2023 in PDF. Let's help you dive into its depths and elucidate how to... - 18 September, 2023

- 2290 Online Form Understanding tax forms can be a challenging task, and one of the forms that often confounds taxpayers is the IRS Form 2290. Known as the 'Heavy Highway Vehicle Use Tax Return,' this form is utilized by truck owners or operators with heavy motor vehicles weighing 55,000 pounds or more that use publi...

- 15 September, 2023

- IRS 2290 Tax Form in PDF Before diving into the heart of our discussion, let's paint a basic picture of the IRS 2290 tax form in PDF format. This form, also known as the Heavy Vehicle Use Tax (HVUT), is used by truck owners or operators reporting a heavy highway motor vehicle. This includes trucks, truck tractors, and buses...

- 14 September, 2023

Please Note

This website (2290-printable-form.com) is an independent platform dedicated to providing information and resources specifically about the 2290 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.